If you haven’t been living under a rock for the last few months then you have likely heard about the new tax plan that is expected to have been finalized and signed by Christmas. Whether you support the passage of this plan or not, it is in your best interest to understand how this change will affect you.

Most People Save

The majority of people in the United States will end up paying less tax in 2018 under the new tax plan. The easiest way to check how much money you can expect to save from the plan is by using this calculator.

New Tax Brackets

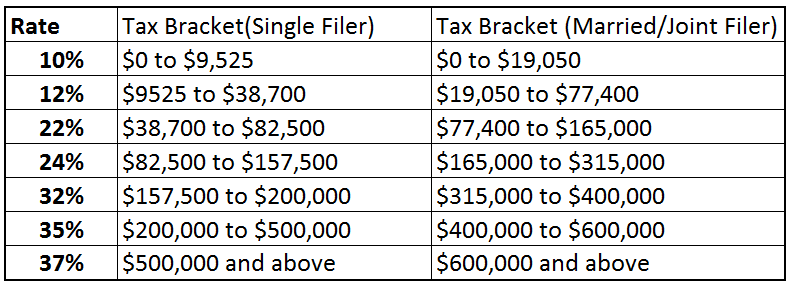

One of the main changes made to our tax structure is within income tax brackets.

2017 Tax Bracket (old)

2018 Tax Bracket (new)

The New Standard Deduction

When filing your taxes you have one of two options: taking the standard deduction, or using itemized deductions. The standard deduction is the easiest route and also the way that most people choose to file their taxes. Only certain individuals can reduce their taxes by a larger amount through using itemized deductions. Click here to see what the IRS has to say about itemized deductions.

The 2017 standard deduction is $6,350 for single filers and $12,700 for married/joint filers. Under the new tax plan that deduction will increase to $12,000 and $24,000 respectively. This change means that the first $12,000 that a single filer earns will not be subject to any federal tax, should they choose the standard deduction.

Calculating Taxes On Your Own

While calculating your own taxes can seem intimidating it doesn’t have to be. To calculate what you should be paying Uncle Sam, do the following:

First, you will need to figure out your “adjusted gross income” or AGI for short. To do this you will need to add up all of the money you made over the past year and then make adjustments. These adjustments include subtracting things like contributions to traditional IRAs and 401(k)s and student loan interest.

Second, figure out taxable income. To arrive at taxable income you should take your AGI and subtract either the standard deduction, or your total itemized deductions depending on which you choose.

Lastly, calculate your federal income tax by applying the rates in the tax brackets to your income.

Calculation Example

For example, let’s say you are a single filer and your AGI is $50,000. You choose to take the standard deduction. This means your taxable income for the 2019 tax year will be $38,000. In this situation your first $9,525 of taxable income will be taxed at 10% and the remaining $28,475 will be taxed at 12%. You should pay a total of $4,369.50 in federal income tax in 2018. The same situation would result in a tax bill of $5,491 under the old tax structure.

Politics aside, I think we are all happy to be paying a tax bill that is 20% lower than it would have otherwise been. I’m sure the person in this example has plenty of things to use the extra $1,121.50 on.

Thanks for reading. Click here to subscribe and never miss another update. You will also gain access to a list of my personal investment holdings.