So you’ve made a few contributions and chosen to manage your 401(k) yourself. Usually the next thing you have to figure out is where you want to invest your money. Most 401(k) plans will give you a selection of mutual funds to choose from. (If you haven’t quite gotten this far check out How To Set Up Your 401(k))

What Are Mutual Funds?

A mutual fund is a tool that allows you to pool your money together with other investors to purchase a collection of stocks, bonds, or other securities that might be difficult to recreate on your own.

Which Funds Should I Pick?

By deciding to manage your own 401(k) (and save tons of money on fees) this is the only additional question you have to answer. Luckily I have the answer for you in two parts.

Time Horizon

The gist here is the longer you have until your retirement age, the more aggressive you should be. How “aggressive” you are is determined by the riskiness of the assets (stocks, bonds, money market funds) you invest in. The riskier the asset the higher the potential return (or loss).

At age 23 my 401(k) is 100% invested in stocks. If I were 50 years old (assuming I’m not already retired by then) I would allocate roughly 75% to stocks and 25% to bonds and if I were 60 that would shift to about 60% stocks and 40% bonds. Risk tolerance is a personal matter, however, and you may be more comfortable with a different allocation than what I have chosen.

Portfolio allocation can get much more complex than just stocks and bonds but for the purposes of a 401(k) your options are usually limited.

Expense Ratios

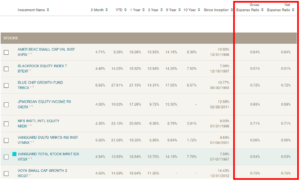

The second thing you need to pay attention to is the fees each fund charges for participating. This is called the expense ratio. These can really eat up your returns over time! Look for a “Gross expense ratio” or “net expense ratio” column like the ones pictured below.

I recommend choosing the lowest cost funds possible. Based on the options given to me I chose to split my contributions between 3 funds:

Blackrock equity index T (BTEXF) – This fund is an S&P 500 index fund (US large cap equity).

Vanguard total stock market index (VITSX)- This fund essentially follows the entire US stock market.

Vanguard developed markets (VTMNX)- This fund gets me international equity exposure by investing in 1,383 common stocks of companies located in developed countries of Europe, Australia, Asia, and the Far East.

I put 1/3 of my bi-weekly contributions into each fund which leaves me with a 2:1 US equity to international equity weighting.

The best part is that the highest expense ratio I’m paying is .06% or $6 a year for each $10,000 invested.

You’re Ready To Go!

There you have it. Now you know how to allocate your 401(k) assets appropriately for your time horizon and pick mutual funds that don’t steal your hard-earned retirement dollars! Have fun, do a little research on the funds offered in your plan if you so choose and happy picking!

Interested in other retirement vehicles? Check out IRA Basics.

Thanks for reading. Click here to subscribe and never miss another update!

Return to The Hierarchy of Personal Finance Needs

Comment below with which fund(s) you chose in your 401(k)!

Do you know someone who could benefit from this information? Conveniently share this blog with the buttons below!