As you are likely aware, every other week I have been picking a company to invest $1000 in as a part of the Let’s Be Millionaires, hail Mary investment series. What follows is an update covering the performance of these picks from January until now (this post was written September 30th, 2018).

A Turn For the Worse

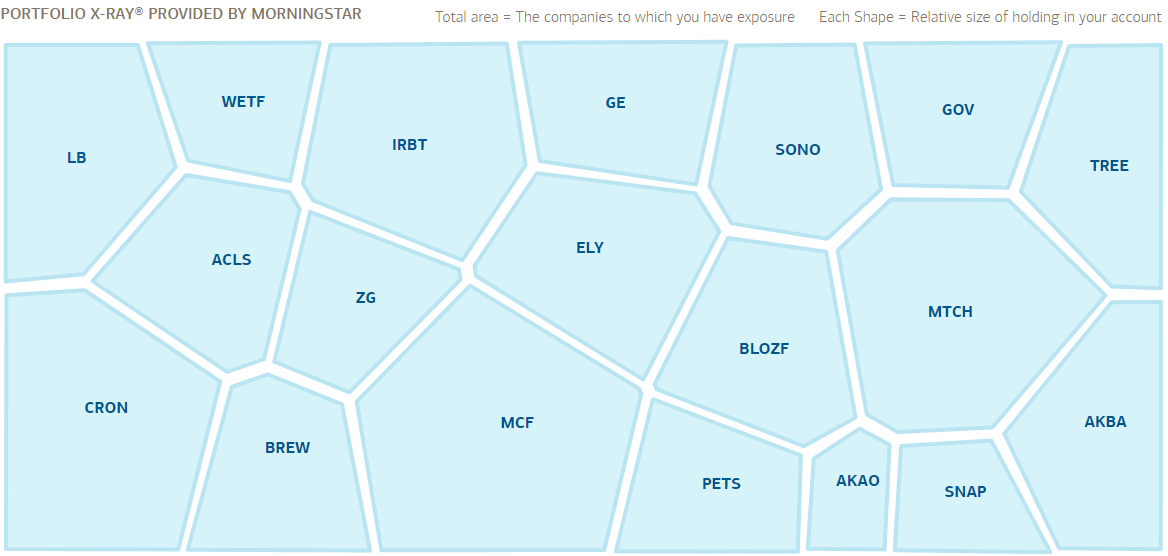

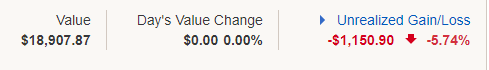

The Hail Mary portfolio turned downward over the past 3 months. Currently sitting at a loss of just under 6% of total contribution value ($20,000), the picks on the whole are underperforming. If you have been following this series closely you may have correctly guessed that the majority of this loss is due to one pick: Helios and Matheson analytics (HMNY), aka Moviepass. This pick is down 99.98% and is essentially a total loss of $1000.

Winners and Losers

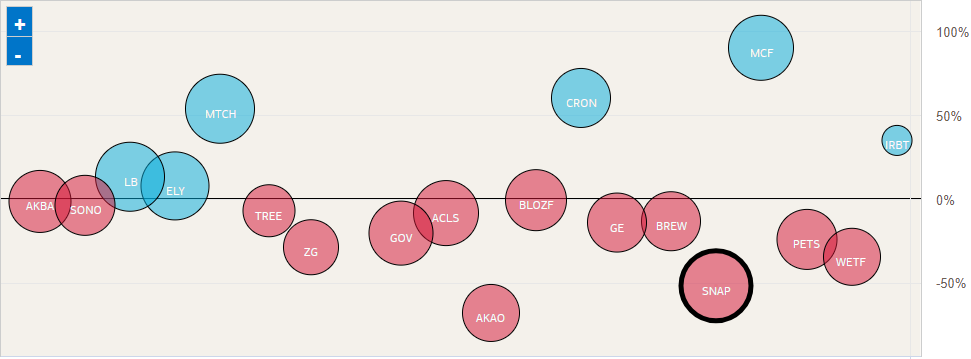

Currently 6 of my picks are positive and 14 are negative not a very good ratio.

Moviepass is off the charts at a negative ~100%.

Achaogen Inc. (AKAO) is currently the portfolio’s second biggest loser with Snapchat (SNAP) close behind. Snapchat and other social media stocks have been getting beaten up lately and Achaogen has been tanking ever sinced having one of its pipeline drugs rejected last quarter.

GOV stock was also a positive performer, having been up 20% before tanking 30% over the course of a couple days due to a merger and some concerns related to tenants.

MCF continue to lead the portfolio on the upside up 90%. Hopefully this pick can continue to sign and trend up further in the 4th quarter.

CRON (Cronos Group) has had a great quarter, rallying significantly as Canadian weed stocks took off over the past few months and Match Group (MTCH) has been an instant success. Picked during this quarter, the stock is already up nearly 54%.

Another notable silver lining is the turnaround in the first pick of the series: iRobot (IRBT). The stock was down 7% at the end of last quarter and has since rallied to finish Q3 up 35%.

The Takeaway

The 2018 Investment Series is now in the final stretches. Watching one of my picks go from $1000 to $0 this quarter was definitely humbling and a good lesson to learn. I like that I am learning about a ton of cool companies that I never would have taken the time to look into before. Also, while performance may not have been stellar, the value of the account has still increased substantially. This account, having been opened at the beginning of this year with $0 in it is a great reminder of what can be accomplished by making smart financial decisions. I think I will have to continue my shopping sprees at the stock market for a long time. I’d rather spend it all there before I can blow it somewhere else.

With 6 picks and 3 months left to go i’m still not throwing in the towel on this portfolio. I’m ready to see these picks finish strong and get us into the green in Q4.

Thanks for reading. Click here to subscribe get investment series updates straight to your inbox. Subscribers also gain access to my complete list of personal investment holdings.

Want to start investing in stocks? Click Here to sign up for Robinhood where trading is free. Signing up through my link will also award you with a free share of stock ranging from $5-$180 in value.

I like the distinction you make about having $$ in there go up even though the returns on the principal are slightly down. 100% on $500 is a lot less than 20k saved with a 6% loss