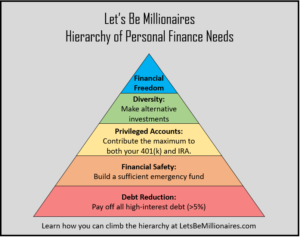

If you ever dabbled in psychology you may remember Maslow’s Hierarchy of Needs, a theory proposed by Abraham Maslow to explain and categorize the stages of personal growth.

I have decided to expand on his work and build a hierarchy of my own: The Hierarchy of Personal Finance Needs.

The Rules Are The Same

As with Maslow’s hierarchy, the general rule of thumb is this: to progress to the next level in The Hierarchy of Personal Finance Needs you must have satisfied the conditions of the prior level(s).

The peak of this hierarchy is financial freedom. I’ll go into my definition of that concept later on in the post.

With these rules in mind, let’s proceed on to the first stage of personal financial growth in The Hierarchy of Personal Finance Needs.

The Need For Debt Reduction

If you have huge chunks of high interest debt not only is your net worth likely below zero, but you probably have a hard time saving much money.

The first stage of the hierarchy is where you focus on eliminating these high interest debts.

I categorize high interest as anything above 5%. If your loans have interest rates of 5% or lower and you are considering paying them off early I strongly encourage you to read this first. You could be missing a chance to make arbitrage profits or other smart financial moves.

The Need For Financial Safety

Once you are no longer in debt, your next personal finance need is financial safety.

At this point you should build an emergency fund. An emergency fund will be your guardian angel when an unforeseen life event causes you to randomly need a large sum of money.

The people who do not have this fund end up using a credit card or potentially a personal loan, putting them right back in serious debt, and back at the first stage of the hierarchy.

The best part is that you can actually turn your emergency account into an investment.

The Need To Maximize Privileged Accounts

So you’ve gotten yourself out of debt and built an emergency fund, well done!

Now you are ready to start putting your money to work through investment accounts.

The first accounts you will want to fill are privileged accounts. Frequently called retirement accounts, these accounts allow you to maximize your investment potential due to their tax advantages.

If you haven’t yet you’ll want to set up your 401(k). If you’ve already set up your 401(k) make sure you are investing it the right way to maximize your 401(k) performance.

Being able to contribute to your 401(k) on a pre-tax basis makes this the best method for paying yourself first. If you aren’t sure exactly what I mean by that then I encourage you to read “Why You Should Always Pay Yourself First.”

The other type of account you will want to have is an IRA. Not sure what an IRA is? Check out IRA Basics.

If you already have an IRA and chose a Roth, go ahead and click here to learn how I invest my Roth IRA.

Before you progress further up the hierarchy you should be contributing the maximum amount allowed to these accounts ($19,000 for 401(k) accounts and $6,000 for IRA accounts). Once your income reaches a certain level your contributions may be limited by the IRS.

The Need For Diversity

Once you are maxing out your contributions to privileged accounts you should invest the excess savings in alternative investments.

Your 401(k) and IRA already have the ability to be diversified with stocks and bonds. At this stage in the hierarchy you should feel free to get creative.

Some alternative investments include: real estate, crypto-currencies, peer-to-peer lending, private equity, commodities and options (derivatives).

The Need For Financial Freedom

The pinnacle of personal finance needs: financial freedom.

Financial freedom is the ability to quit your job and maintain the standard of living that you desire. It is the ability to have no financial worries in the world.

If your standard of living can be sustained with an income of $50,000 a year then you could achieve financial freedom with a $1,000,000 bond portfolio that pays a 5% return. Just picture that: the moment you realize that you have earned, saved, and invested enough money that now your money can make you enough money to live on. Figure out how much you need for your own personal financial independence.

If you want a higher standard of living then you just need to build up a larger stash.

How To Climb The Hierarchy

Obviously, we would all love to be able to satisfy our personal finance needs. Nobody wants to be in debt, and everyone would love to have $23,500 each year that they just don’t need and can tuck away into privileged accounts.

The key to moving up the ranks in The Hierarchy of Personal Finance Needs boils down to hustle and sacrifices. Sorry if you were looking for pixie dust.

The quicker you can increase your income and the better you can manage your spending, the faster you will find yourself moving up the hierarchy.

Whether you negotiate a raise or add a secondary income you will have more income to start with.

If you want to diversify away from just having active income then you can find ways to generate passive income.

Once you have that income, whether you decide to save money by eating PB&Js or use other everyday savings tools you will have more money left over at the end of the day to put towards your personal finance needs.

There Are Exceptions To Every Rule

While you should generally only focus on achieving these hierarchy steps in order there are some exceptions to this which I want to make sure to note.

401(k) contributions: You should always contribute enough to maximize your employer match, even if you are still paying off debt. These contributions should not be missed.

Alternative investments: Life is short, and sometimes you see an investment opportunity that you just don’t want to miss out on. If you find something that you are passionate about and you have the opportunity to invest then I urge you to go for it.

Even if you have not maxed out your privileged account contributions for the year, investing in a friend’s startup or any idea that you truly believe in will make you much happier and potentially wealthier than you would be from just locking those funds up in stocks and bonds.

Thanks for reading. Click here to subscribe and never miss another update!

Let’s climb the hierarchy! Share the hierarchy with your friends using the buttons below.

Awesome post! I think it would be cool to write another or add a section on this one that makes it possible for people to understand realistic timelines on ticking off each of the needs on the hierarchy. Some people might take 10 years to pay off their debt, and the amount of time you have to spend working within diversity and privileged accounts before you achieve financial freedom will be significant also. I personally am just hanging out debt-free with a small emergency fund, waiting for the job to start so that I can really get to building wealth. Keep ’em comin!

I believe you commented on another post saying that you flip bicycles. Sounds like you have some alternative investing going on there with your very own small business.

As you pointed out, timelines for moving up the hierarchy are going to be very different for each person. I may write on that topic, but for now I would like to help people focus on speeding up their timeline, whatever it may be.

Darn, no pixie dust. And here I thought you had the get-rich-quick solution to life.